|

A brief guide to what you need to know:

Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020

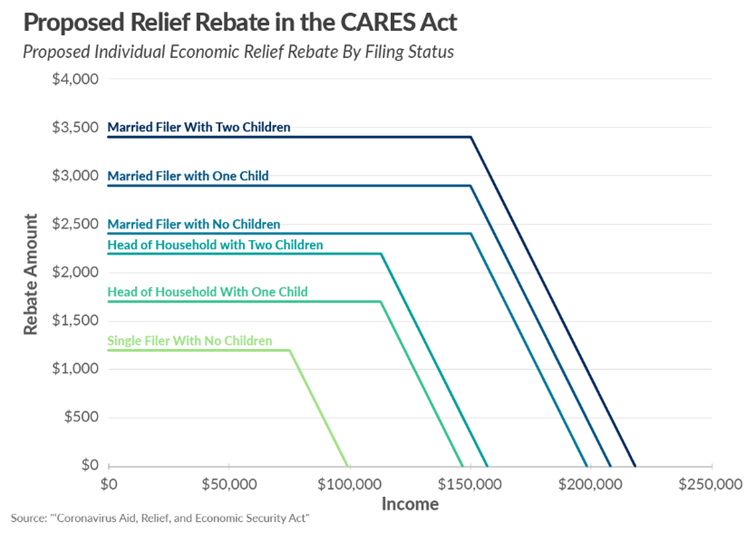

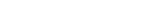

DIRECT PAYMENTS ("RECOVERY REBATE"):

- $1200/person + $500/child age 16 or under.

- Phase Out: $150k MFJ, $112,500 HOH, $75k Single

- For every $100 above phase-out threshold, $5 is lost.

- Eligibility based on AGI on 2019 tax return or 2018 tax return if you have not yet filed.

- The rebate is technically a credit against one’s 2020 tax liability. Taxpayers that did not receive the full rebate or any rebate this year as an advanced credit may still qualify based on their 2020 income when they file taxes early next year.

RETIREMENT:

- 2020 RMDs waived.

- "Coronavirus-Related Distribution":

- Up to $100k distribution allowed from retirement accounts in 2020 without 10% Early Distribution penalty.

- Not subject to mandatory withholding requirements.

- Distribution income may be spread over 3 years, unless elected otherwise.

- Option to repay the distribution in one or multiple payments over the next 3 years.

- Plan loan max increased from $50k to $100k with one-year payment delay.

CHARITY and TAXES:

- Don't itemize but still give to charity? You can now count up to $300 as an above-the-line deduction in 2020.

- These will be called "Qualified Charitable Contributions"...not to be confused with "Qualified Charitable Distributions".

- Qualified Charitable Contributions must be made in cash and can NOT be used to fund a Donor-Advised Fund or 509(a)(3) “supporting organizations”.

BUSINESS:

- PAYCHECK PROTECTION PROGRAM: (Loans for businesses with 500 or fewer employees)

- Business loans available up to a maximum of the lessor of $10 million, or 2.5 times the average payroll costs over the previous year (excluding annual compensation of amounts over $100,000 per person).

- The amount eligible to be forgiven is the amount spent, during the first 8 weeks after the loan is made, on:

- Payroll costs, excluding prorated amounts for individuals with compensation greater than $100,000

- Rent pursuant to a lease in force before February 15, 2020

- Electricity, gas, water, transportation, telephone, or internet access expenses for services which began before February 15, 2020

- Group health insurance premiums and other healthcare costs

- Forgiveness is reduced proportionally by any reduction in employees retained compared to prior year and a 25% or more reduction in employee compensation.

- Maximum loan interest rate is 4% for a max term of 10 years.

- EMPLOYEE RETENTION CREDIT

- Refundable payroll tax credit worth up to 50% of qualified wages (inclusive of health insurance) up to $10k/employee.

- Triggered if operations are fully or partially suspended due to COVID-19. At least one quarter’s revenue in 2020 must be more than 50% less than the revenue for the same quarter in 2019

- Small Business (100 or fewer employees): All wages (up to $10k/employee max) count.

- Big Business (100 or more employees): Credit only applied to employees not working due to COVID-19.

- DEFERRED PAYROLL TAXES (Including the 'employer' portion for those self-employed)

- Don't qualify for loan forgiveness or a refundable payroll tax credit? There's still something for you.

- 50% of payroll taxes from date of enactment to end of 2020 due 12/31/2021

- The other 50% due 12/31/2022

Tracking # 32597-01-01

Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor, member FINRA/SIPC.

|